Launching a new product in the manufacturing industry is an exciting yet challenging endeavor. Among the many factors that determine the success of a new product launch, inventory planning stands out as one of the most critical. How well you plan your inventory can make the difference between a smooth, successful rollout or a logistical nightmare with stockouts or excess stock.

Why Inventory Planning is Critical for a New Product Launch

New product launches present unique challenges for inventory management. When you introduce a product to the market for the first time, there is no historical sales data for that exact item. This uncertainty makes inventory planning for new product launches both crucial and complex. If you underestimate demand, you risk running into stockouts – empty shelves and unfilled orders that can frustrate customers, harm your brand reputation, and lead to lost revenue. On the other hand, if you overestimate demand, you could end up with overstock – tying up capital in unsold goods, incurring high storage costs, and possibly having to write off obsolete inventory if the product doesn’t sell as expected.

In the manufacturing sector, these inventory decisions carry even more weight. Manufacturers not only have to ensure enough finished goods are available for the launch, but also need to manage raw materials and components for production.

A misstep in planning can idle production lines or overflow warehouses. For example, history is full of cases where companies launched a much-anticipated product only to have it falter because of inventory misjudgments – either shelves went empty just as demand peaked, or warehouses were left holding mountains of unsold units. Such outcomes can be extremely costly.

Effective inventory planning for a product launch helps balance these risks. It ensures that your investment in a new product is supported by a supply of goods that meets customer demand without waste. Good planning aligns closely with other business functions too: it connects marketing forecasts, sales targets, and production schedules. In short, inventory planning is the backbone of a successful launch, enabling you to fulfill orders promptly and keep the business financially healthy.

Common Challenges in New Product Launch Inventory Planning

Planning inventory for a new product isn’t just a routine extension of normal inventory management – it comes with its own set of challenges that managers must be prepared to handle:

Demand Uncertainty: Without past sales data for the new product, forecasting demand is notoriously difficult. Even with market research and similar product analogies, there’s always a degree of guessing involved. A new product might take off faster than anticipated or, conversely, sell slower, making initial inventory decisions tricky.

Short Lead Time and Launch Pressure: Launch timelines can be aggressive due to competitive pressures or marketing schedules. This often means you must commit to production and inventory decisions early, sometimes before you have solid market feedback. Ramping up production quickly, or holding inventory ready in multiple locations by launch day, requires careful timing.

Supply Chain Adjustments: A new product may involve new raw materials or new suppliers. Ensuring suppliers can deliver the required components on time (and at the right quality) is a challenge. Any changes in the Bill of Materials (BOM) need to be communicated and planned with suppliers. If a key component has a long lead time, you must account for that in your inventory plan well in advance of the launch.

Manufacturing Capacity: Your production lines might need adjustments to accommodate the new product. There could be equipment changeovers, new tooling, or even the need for additional shifts or outsourcing production. A lack of manufacturing capacity planning could result in not being able to produce enough units for launch, or conversely producing too many and straining your facilities.

Coordination Across Departments: New product introduction involves multiple departments – R&D, marketing, sales, manufacturing, procurement, and logistics. If these teams aren’t in sync, inventory planning can suffer. For instance, if marketing runs a big promotion or if sales plans an early surge without communicating it, you might not stock enough inventory in the right place. Cross-functional coordination is essential to align demand expectations with supply readiness.

Impact on Existing Products: If your new product is a replacement or an upgrade to an existing product line, there’s the issue of cannibalization. The new product might reduce demand for your older products. Inventory planning must account for this shift – ramping down the old product’s inventory and clearances, while ramping up the new. Failing to manage this transition can lead to excess stock of outdated models or shortages of the new one.

Distribution and Logistics Complexities: Deciding how to allocate initial stock across warehouses, distribution centers, or retail locations is challenging. Place too much inventory in the wrong location and it may sit while other areas face shortages. Since you might not know exactly where demand will spike, the initial distribution plan must be done with limited information and be flexible.

Financial Risks: Inventory for a new product ties up capital. Every unit produced but unsold by launch day is essentially cash sitting on a shelf. Especially for expensive products or tight-margin businesses, there’s pressure to minimize inventory without compromising sales. Management expects inventory planners to justify their decisions with solid rationale to avoid financial fallout.

Customer Expectations: In today’s world, customers (whether distributors, retailers, or end consumers) often expect immediate availability when a product is launched. A highly anticipated product that is “out of stock” right after launch can lead to customer dissatisfaction or defection to competitors. Conversely, deep discounts post-launch to clear excess inventory can hurt the brand. Meeting customer expectations requires precise planning and often a bit of luck in how well the forecast matches reality.

Despite these challenges, proper planning and preparation can significantly mitigate risks. Next, we’ll walk through a how-to guide on inventory planning for new product launches, breaking it down into practical steps.

Steps for Effective Inventory Planning in a New Product Launch

Planning inventory for a new product launch is a multi-stage process that spans from the pre-launch phase through the launch and into the post-launch period. Below are the key steps and best practices to ensure you cover all bases in your inventory planning process:

1. Assemble a Cross-Functional Launch Team

Successful inventory planning begins with collaboration. Form a cross-functional team that includes representatives from all the key departments: supply chain/inventory management, production (manufacturing operations), sales, marketing, finance, and even product development. This launch team will be responsible for sharing information and aligning plans across the organization.

Bringing everyone to the table early helps ensure that forecasts and plans are realistic and that potential issues are flagged. For example, marketing can provide input on promotion schedules or target markets, sales can share insights from customers or distributors, and production can inform how quickly manufacturing can ramp up. By collaborating, the team can set a unified goal for the launch (e.g., a target sales volume in the first quarter) and ensure each department’s plans support that goal.

Establish regular meetings or check-ins for this team leading up to the launch. In these meetings, update each other on any changes – such as updated demand projections, production status, or supply chain concerns – and adjust the inventory plan accordingly. This collaborative approach is often part of a broader Sales and Operations Planning (S&OP) process or a New Product Introduction (NPI) process in many companies. The key is that no single department plans in isolation; a new product launch is a company-wide effort, and inventory planning lies at its crossroads.

2. Conduct Thorough Demand Forecasting

With the team in place, the first major task is to forecast the demand for the new product as accurately as possible. This step is arguably the most important, since your production and inventory decisions will stem from these predictions. However, forecasting for a new product is tricky, since there’s no direct historical data. Here’s how you can approach it:

- Use Analogous Products: Look at sales data for products similar to the new product. This could include your company’s past product launches in the same category or even competitors’ products if such data is available. For instance, if you’re launching a new model of a gadget, examine how previous models performed initially, or how a competitor’s recent launch fared.

- Market Research and Pre-Launch Signals: Leverage any market research, customer surveys, or focus group data that was collected during product development. If you took pre-orders or gauged interest via a marketing campaign, use those numbers to inform your forecast. Sometimes B2B manufacturers work closely with a few key clients or distributors to get initial order commitments that indicate likely demand.

- Factor in Marketing Plans: Align with the marketing team to understand the scale of the launch activities. A product backed by a big advertising push or a broad distribution rollout will likely generate higher initial demand than one with a soft launch. Promotions, launch events, and media buzz can dramatically influence the sales curve in the first days and weeks.

- Seasonality and Timing: Consider the timing of the launch. Is it hitting the market during a peak season or a slow period? Seasonality can affect how much inventory you need. For example, launching a product right before a holiday season or a major shopping period may warrant building extra stock to meet the uplift in demand.

- Range of Scenarios: Given the uncertainty, it’s wise to create multiple forecast scenarios – e.g., conservative, likely, and optimistic cases. This range helps in planning contingencies. You might plan initial inventory around the likely scenario but have backup plans (like additional production capacity or supplier stock on standby) if demand leans towards the high end. Likewise, know your “cut losses” point if initial sales are far below expectations.

- Account for Cannibalization: If the new product is expected to take market share from one of your existing products (for instance, a new generation that improves on an older model), adjust your overall demand plan accordingly. Forecast how much the sales of the older product will decline and the new will rise, rather than simply adding them together. This ensures you don’t overstock by producing both at full volume. It also helps to plan ramp-down strategies for the old inventory, such as discounts or discontinuation timing, to avoid a glut of outdated stock.

- Leverage Expert Judgment: Quantitative data may be limited, so rely on the expertise of your team as well. Gather input from sales reps, industry experts, or consultants familiar with the product domain. Often, their experience can help fine-tune the numbers or identify potential pitfalls that pure data might miss.

Document all the assumptions behind your forecasts (such as expected market size, anticipated first-month sales, growth rate, etc.). This will be useful for both executing the plan and reviewing it later. Remember that the forecast is a living estimate – you will refine it continuously as you get closer to launch and especially once the product is in market and real sales data starts coming in.

3. Secure Your Supply Chain (Suppliers and Materials)

Inventory planning isn’t just about the finished product – it starts upstream with your suppliers and raw materials. A new product might introduce new components or require existing suppliers to scale up their deliveries. To prevent supply hiccups from derailing your launch, work closely with suppliers early on:

- Communicate Early and Clearly: Share your new product plans with key suppliers as soon as possible. Provide them with forecasts of your material requirements, even if tentative. If the product involves new materials or parts, ensure suppliers understand the specifications and timeline. For example, if a new type of chip or a custom-made part is in the product, the supplier needs sufficient lead time to prepare and ramp up.

- Assess Supplier Capacity and Lead Times: Don’t assume your suppliers can instantly handle the volumes you need for launch. Have conversations to verify their capacity. They might need to increase their production, stockpile raw materials themselves, or even outsource to meet your needs. Also, double-check lead times for each critical component and adjust your schedule to procure them in time. If a particular component has a 3-month lead time from order to delivery, you must place orders well in advance.

- Qualify Backup Suppliers: Launch is not the time to discover that a single-source supplier can’t deliver. If any material is mission-critical and only sourced from one vendor, consider qualifying an alternate source if possible, or at least have a contingency plan for emergencies. This way, if supplier A runs into issues, supplier B can step in (even if at a smaller capacity).

- Finalize the BOM and Changes: Ensure that any last-minute design changes (common in new product development) are communicated to all supply chain partners. Even a small change in a component or a spec can cause delays if a supplier isn’t informed promptly. It’s wise to lock down the Bill of Materials early enough so that procurement can proceed without late surprises.

- Logistics Readiness: If materials are coming from overseas or distant locations, factor in transit times, customs, and potential delays. Plan your inbound logistics so that raw materials arrive before production needs them. Some companies expedite initial shipments for launch via air freight to save time (accepting higher cost) and then switch to cheaper shipping for later restocking.

- Inventory of Critical Materials: Depending on risk, you might hold some safety stock of critical raw materials before launch. If a particular component has a history of supply instability or is essential to the product’s functionality, having a buffer can protect your production schedule if the supplier has a shortfall or delay.

By solidifying your supply chain, you build a strong foundation for your inventory plan. The goal is to ensure that when it’s time to build your new product, all the pieces are at hand and ready. A well-coordinated supply chain means you can produce to your forecast without last-minute scrambles or quality issues arising from rushed materials.

4. Ensure Production Capacity & Flexibility

With demand forecasted and materials on their way, the next step is to make sure your manufacturing operations can deliver the product quantities needed for the launch. Assess your production capacity and create a plan that aligns with your inventory targets:

- Evaluate Internal Capacity: Look at your current production schedule and output. How much of your manufacturing capacity is currently utilized by existing products? Determine if you have enough free capacity to produce the new product at the volume required. This evaluation includes machinery capacity, available labor (shifts), and any specific production processes that might be bottlenecks.

- Trial Runs and Process Optimization: If the new product is something your factory hasn’t made before, it’s critical to conduct trial production runs. Produce a pilot batch or initial samples using the final manufacturing process. This serves two purposes: it helps identify any tweaks needed in the process or equipment, and it produces samples for quality testing. During these runs, involve your engineering, R&D, and quality control teams to quickly resolve any issues that surface – whether it’s a machine setting that needs adjustment, a mold that isn’t filling correctly, or a quality defect that appears. Catching and fixing these issues early prevents delays during the actual production ramp-up.

- Capacity Augmentation if Needed: If your analysis shows that you cannot meet the expected demand with existing capacity, you have decisions to make. One option is investing in additional equipment or expanding facilities (though this might only be viable for launches with long lead times or if the equipment has other uses). Another common approach is to use contract manufacturing or outsource a portion of production to a third-party manufacturer, especially for the initial surge. For instance, if you’re launching a new electronic device and your factory can make 10,000 units a month but you need 20,000 units for the launch month, you might subcontract the extra 10,000 to a partner.

- Flexibility and Scalability: Design your production plan to be as flexible as possible. Perhaps plan for an initial production rate that can be accelerated if demand is higher than forecast or decelerated if demand is lower. This might involve arranging for temp workers or an extra shift that can be called upon on short notice, or reserving some overtime hours. It might also mean initially producing at a moderate rate and then scaling up once you see actual order volumes.

- Quality and Compliance: Don’t let the rush to hit launch quantities compromise quality. Ensure that all quality control procedures are in place and that the production team is well-trained on the new product. In regulated industries (like automotive, aerospace, or medical devices), make sure you’ve met all compliance or certification requirements in the production process before full-scale manufacturing. Quality issues at launch can cause returns or even a halt in sales, which would wreak havoc on inventory planning.

- Coordinate with Inventory Goals: Work backward from the launch date. If you need a certain number of finished units by D-day (launch day), schedule your production accordingly. Account for production lead time, any time needed for packaging, and shipping finished goods to distribution points. A common practice is to have the launch inventory ready at least a couple of weeks (or more) before the launch, especially if it needs to be distributed to various regions or warehouses.

By ensuring production readiness, you minimize the risk that inventory shortfalls will occur due to factory issues. Essentially, this step is about turning the theoretical inventory plan (numbers on paper from the forecast) into tangible product output, reliably and on schedule.

5. Leverage an Inventory Management System (CyberStockroom)

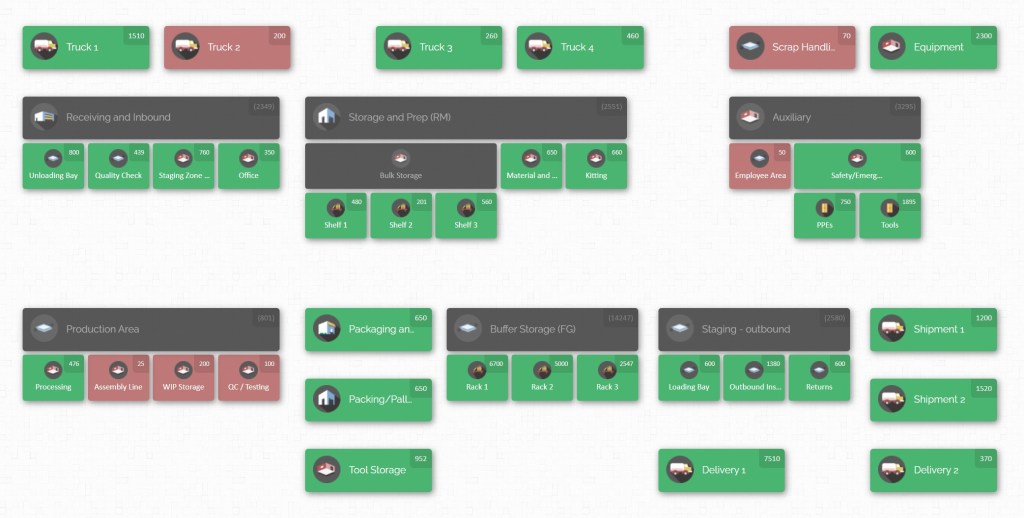

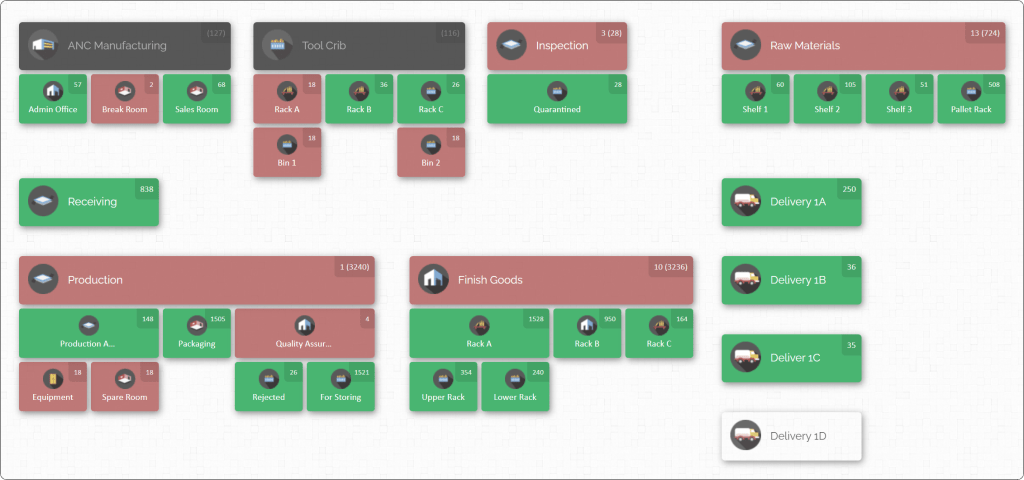

Inventory planning and execution for a product launch can quickly become complex, especially when multiple products, parts, and locations are involved. This is where the right technology can be a game-changer. Utilizing a robust inventory management system helps keep track of all the moving pieces and provides real-time visibility into stock levels. CyberStockroom is one such tool that can greatly support your new product launch inventory efforts.

CyberStockroom is a cloud-based inventory management platform known for its unique visual inventory map feature. Instead of just dealing with spreadsheets and tables, CyberStockroom allows you to create a virtual map of all your inventory locations – from factories and warehouses to distribution centers and retail outlets. For a new product launch, this means you can literally see where all your stock is at any given moment, on one interactive screen. Here’s how leveraging CyberStockroom (or a similar advanced inventory system) can enhance your launch planning:

- Unified Inventory Visibility: During a launch, you might have inventory moving or staged at different places – some at the manufacturing plant, some in transit, some at regional warehouses. CyberStockroom’s map-based interface shows how many units of the new product (and even critical components, if you track those) are where. This answers the vital question: “How many of what do we have and where is it located?” at a glance. Such visibility ensures nothing falls through the cracks. For example, if one distribution center’s stock is running low due to higher-than-expected local demand, you’ll spot it quickly and can reallocate stock from another location or expedite a resupply.

- Real-Time Updates and Tracking: CyberStockroom supports real-time tracking of inventory movements. As products are produced and checked into a warehouse, the system updates. If inventory is transferred from one location to another (say, from a central warehouse to a regional one or from a warehouse to a retailer), a quick drag-and-drop on the map or an update in the system reflects that change. This immediacy means your team is always working with the latest information – crucial during the fast-paced launch period.

- Barcode Scanning and Accuracy: The platform supports barcode scanning, which can be very useful during a new product launch when large volumes of goods are being received, moved, or shipped. By scanning items into locations, you reduce manual data entry errors. Accuracy is everything in a launch; you don’t want to think you have 500 units in stock only to find out 50 of them were miscounted. Barcoding helps maintain an accurate count of your new product across all locations.

- Collaboration and Accessibility: Because CyberStockroom is cloud-based, your entire launch team can access inventory information from anywhere – whether they are on the factory floor or in a meeting room tracking launch progress. There’s no need to pass spreadsheets back and forth. This fosters better collaboration; everyone from the production manager to the sales director can see the current inventory status. Role-based permissions allow different team members to view or update relevant information without compromising security.

- Historical Data for Next Time: All the data captured during your launch – how inventory moved, where bottlenecks occurred, how quickly certain locations ran out – is stored. After the launch, you can analyze this within the system’s reporting module to learn lessons for next time. It’s much easier to improve your next product launch when you have detailed analytics to review.

- Ease of Use: Launch periods are hectic, so ease-of-use in your software is important. CyberStockroom’s visual approach with drag-and-drop features means even team members who are not “data people” can interact with the inventory system intuitively. This can be a relief to teams who otherwise might struggle with complex ERP interfaces during a high-pressure time.

In summary, leveraging an inventory management system like CyberStockroom provides control and agility. It complements the human planning efforts with technology, helping you manage the execution of your inventory plan flawlessly. By having real-time visibility and alerts, you can respond to issues immediately (for example, rerouting stock or expediting production if needed). As you continue through the launch process, this tool will be an invaluable backbone keeping all inventory information organized and accessible.

6. Plan Initial Stock Levels and Production Run

One of the key decisions in inventory planning for a launch is: How much product should we have on hand on day one? Striking the right balance for initial stock levels is crucial. At this stage, using the demand forecast from Step 2, determine the initial production volume and inventory build-up for the launch:

- Initial Production Quantity: Often, companies will not produce 100% of the projected first-phase sales upfront, to avoid overcommitment if the forecast is off. A common strategy is to produce a significant portion of the forecast (for example, 60-80% of the expected first 3-month demand) as initial inventory. The exact percentage might vary depending on factors like shelf life and confidence in the forecast. For instance, if the product is perishable or has high obsolescence risk, you might lean toward the lower end of that range. The goal is to have enough stock to satisfy early demand and buffer against minor forecasting errors, but not so much that you’re stuck with huge excess if things go sideways.

- Timing the Production Run: Plan the production schedule so that all initial inventory is ready and in position slightly before the launch date. If your launch date is fixed (say a public announcement or a coordinated release across stores on a certain day), you want to complete production and have goods at the warehouses a week or two in advance. This ensures any last-minute distribution can happen and also provides a cushion in case production took slightly longer than expected. It’s far better to be ready a bit early than to miss the launch date due to production overruns.

- Quality Assurance for Launch Batch: The first batches produced for launch should undergo thorough quality checks. This ties into your inventory plan because discovering a quality issue at the last minute can wipe out a chunk of your sellable inventory (if, for example, you have to scrap or rework units). It’s wise to have your quality team on high alert during the initial production run and even have contingency plans if a portion of inventory is found defective (e.g., can you rework it quickly, or do you have capacity to reproduce it?). Consistent quality ensures that all inventory you’ve counted on for launch is actually usable.

- Allocate Between Channels (if applicable): Determine how the initial stock is split between different sales channels or customer types. For example, if you sell both through distributors and directly to consumers, how much inventory goes to each? Or if you are launching in multiple regions/countries at once, how many units will each region get initially? This decision should be guided by your forecast breakdown by channel/region and any strategic priorities (perhaps one market has higher strategic importance and gets more buffer stock).

- Document Assumptions: Clearly document why you chose the initial stock level that you did. For instance, “We are producing 50,000 units for launch, which is roughly 70% of projected 3-month demand, because we anticipate an initial surge followed by the ability to restock monthly.” Having this written down helps if later someone questions the decision or if, after launch, you want to evaluate whether that percentage was appropriate.

- Stay Agile: Ensure that your production plan post-launch can adjust. If demand comes in much higher, can you quickly produce a second run or authorize overtime to boost output? If demand is lower, can you taper production to avoid building unnecessary inventory? The initial stock is not the end of the story; it’s the first chapter. Your ability to respond after the launch (which we’ll discuss in monitoring) depends on how flexibly you can manage subsequent production or procurement.

By carefully calculating the initial production and inventory, you set the stage to meet customer demand as the product hits the market. It instills confidence among sales teams and distributors that stock will be available, and it positions you to either capitalize on a hit product or limit exposure if the product needs time to gain traction.

7. Strategize Distribution and Warehousing

Having a pile of inventory in one place won’t do much good if your customers or retailers are elsewhere. A strategic distribution plan is necessary to put products in the right place at the right time for launch. This step is about deciding where all that initial inventory should go and how it will flow to the market:

- Initial Allocation Plan: Based on your launch strategy, decide how to allocate the initial stock across your distribution network. If you operate a central warehouse model, you might keep a large portion of inventory in a central or regional warehouse and then push it out to retail stores or local distributors as orders come in. Alternatively, if you promise availability in stores on launch day, you’ll need to ship inventory to those stores or to e-commerce fulfillment centers ahead of time.

- Use Analogous Data: If you have existing products in similar categories, use their sales-by-region or sales-by-store data to guide allocation. For example, if the Midwest usually accounts for 25% of the sales in this product category, initially allocate roughly 25% of launch inventory to the Midwest distribution center. The idea is to use any proxy data you have to make the best guess of where demand will materialize.

- Avoid Over-Distribution: One common tactic is to keep inventory upstream as long as possible until demand patterns become clear. Rather than immediately splitting all your inventory into hundreds of small chunks for every store (where it might get stuck if that store’s demand was overestimated), you can position more inventory at regional hubs or warehouses. Then, once you see which stores or regions are selling out, you can quickly ship additional stock there from the regional hub. This minimizes the chances of a situation where one store has piles of unsold stock while another is empty-handed. Essentially, it’s a semi-pull strategy: you push enough to get started everywhere, but keep a reserve centralized to react to actual sales.

- Logistics Coordination for Launch Day: If the product launch is synchronized (say an online release at midnight, or shelf release on a specific date), plan the logistics so that inventory arrival aligns with that. Warehouses might need to work overtime to ship products just-in-time to stores. Trucks or delivery schedules should be arranged in advance. Clear communication with logistics providers (trucking companies, 3PLs, etc.) is key – they should know there’s a “big push” happening. Build in some buffer for transportation delays; for example, ship a few days early if possible to account for any unforeseen delays in transit.

- Warehouse Space and Handling: Consider the warehousing implications. The new product will take up space – do you have enough space in your existing warehouses, or do you need overflow storage (especially if this product is large in size or you’re carrying a lot of it)? Make sure the warehouse staff is prepared for receiving and handling the new product, which might include new barcodes or handling instructions. Sometimes a new product might require special storage conditions (temperature, security for high-value items, etc.), and the warehouse must be equipped for that.

- Inventory Buffer in Key Locations: If your network has critical nodes (like a main e-commerce fulfillment center or a flagship store), consider positioning a little extra safety stock there for launch. Those are places where a stockout would be most visible or damaging. A flagship store running out on day one, for instance, could make headlines or at least disappoint your biggest fans.

- Distribution to International Markets: If the launch is global, decide if inventory will be regionally produced or all exported from a central location. International launches add layers of complexity with longer shipping times and customs. In such cases, you may need to send inventory to international warehouses well in advance to ensure they clear customs and are in place by launch day.

A well-thought-out distribution plan ensures that your initial inventory investment pays off with high product availability where it matters most. It also sets up the mechanisms for continuing supply after launch – which trucks go where each week, how new orders will be fulfilled promptly, etc. The idea is to make product availability a strength of your launch, not a weakness.

8. Set Safety Stock and Contingency Plans

No matter how good your plan is, reality can throw curveballs. In inventory planning for a new product, it’s prudent to expect the unexpected and have contingencies:

- Safety Stock: Decide on a safety stock level for the new product and possibly for critical components as well. Safety stock is a small buffer of inventory beyond the forecasted amount, held to protect against variability in demand or supply. For a new product, you might set a higher safety stock percentage initially due to greater uncertainty. This safety stock could be held at a central warehouse rather than dispersed (tying back to the strategy of keeping an upstream reserve). It can save you if demand is a bit higher than anticipated or if there are minor hiccups in production replenishment.

- Contingency for Demand Surges: What’s the plan if your product is a runaway success and demand is double your forecast? It’s a good problem to have, but only if you can respond. Identify how you would rapidly scale up. This might involve lining up suppliers for rush orders, having an expedited production plan ready (like converting an optional second shift, or activating that contract manufacturer on standby), or prioritizing certain markets to receive inventory first if supplies are limited. Discuss these scenarios with the cross-functional team: for example, marketing might tone down promotions if supply can’t keep up, to avoid customer disappointment.

- Contingency for Slow Uptake: Conversely, what if sales are much slower than expected? Besides scaling down production (to avoid building even more excess), think about how to handle the inventory already produced. Is there a plan for a promotional push, bundling the product, or offering it through alternate channels to stimulate demand? Also, consider financial contingency: if a lot of capital is tied in unsold stock, at what point might you reduce price or write-off stock? Having criteria for these decisions in advance can make them less emotional if the time comes.

- Quality or Recall Crises: It’s rare but worth considering – if a quality issue arises (say a defect discovered in early batches requiring a recall or hold on sales), how will you manage the inventory? You might need to quarantine certain lots in your warehouses, or expedite replacement parts to fix units in the field. Having a protocol for this, even broadly outlined, can save precious time.

- Alternative Uses: If the new product shares components with other products, or if it can be reworked into something else, note those possibilities. For instance, if you have a modular product, maybe unsold units could be repurposed for a different customer segment or used internally for demos or training. It’s not exactly a plan A, but it’s good to think of these plan B uses so inventory doesn’t go completely to waste if it doesn’t sell.

- Insurance and Financial Buffers: Ensure that any particularly valuable inventory is insured appropriately (especially in transit or storage). Also, work with finance on how much write-down budget or reserve might be needed for new product inventory – finance folks often appreciate when inventory planners acknowledge risk and have some mitigation or reserve in mind.

- Communication Plan: If the contingency involves big decisions (like delaying a launch due to stock unavailability or quickly replenishing due to high demand), establish a communication plan. Who makes the call and who needs to know? For example, if stock is running out fast, at what point do you tell sales or distributors “we’re backordered for X days”? Keeping stakeholders informed in a crisis helps maintain trust.

Setting safety stock and contingency plans is essentially about being proactive. You hope not to need these measures, but having them in place is like having a safety net. It ensures that even if things don’t go perfectly according to the primary plan, you have options and strategies ready to protect the launch’s success and the company’s investment.

9. Monitor the Launch and Adjust in Real Time

The moment of truth has arrived – the product is launched and customers are placing orders. However, the work of inventory planning isn’t over; in fact, it’s now in a critical, dynamic phase. You need to closely monitor what actually happens during the launch and be prepared to adjust on the fly:

- Sales Tracking and Analytics: As soon as the product is live, start tracking sales against your forecast. How do the first day and first week sales look compared to what was expected? Modern sales systems or even direct POS (point-of-sale) data from retailers can give you early indicators. If you see a big deviation (high or low), you can start executing your contingency plans rather than waiting. For example, if sales are double forecast in the first 48 hours, you might immediately authorize overtime in production or trigger the supplier to ship extra materials (because you know replenishment will be needed faster).

- Inventory Dashboard: Use your inventory management system (like CyberStockroom mentioned earlier) to keep an eye on stock levels across all locations in real time. Set up a dashboard that shows, for instance, units on hand at each distribution center, units in transit, and units on backorder (if any). This makes it very visible if, say, the West Coast warehouse is running low while the East Coast still has plenty. The team can then decide to re-route shipments or shift inventory as needed.

- Communication with Sales/Customer Service: Keep open lines of communication with those on the front lines – sales reps, customer service, account managers, or store managers. They often receive the first feedback, such as “Customers are asking for more of X color” or “We’re almost out of stock at Store Y.” Rapid feedback from these sources can sometimes catch issues before the data even shows it (for example, if a big bulk order is about to come through, a sales rep’s heads-up could allow you to prepare).

- Adjust Distribution on the Fly: Be ready to redirect inventory shipments based on actual demand patterns. If one region is selling faster than another, consider moving some inventory from the slower region to the hotter region. Use expedited shipping if necessary – a bit of extra shipping cost is worth it to capture sales and keep customers happy during a launch. The agility afforded by your earlier decision to keep some inventory central or by having a system that easily logs transfers will pay off here.

- Continuous Reforecasting: Update your demand forecast regularly (daily or weekly) during the early launch period using the actual data coming in. This updated forecast should feed into your production and procurement plan. If the trend shows higher sustained demand, you might need to place rush orders for more raw materials or up the next production batch. If it shows lower, you might cancel or push out some supplier orders to avoid excess. Essentially, treat the launch as an active learning phase – your initial assumptions are being validated or corrected, and your plan should evolve accordingly.

- Resolve Issues Quickly: If any supply chain issues arise (for example, a shipment got delayed or a batch failed quality check), gather the team (virtually or physically) immediately to problem-solve. In a launch, speed of response is crucial. Maybe you’ll decide to air freight a replacement shipment, or maybe activate that backup supplier to cover a shortfall. These decisions need to happen in hours, not weeks, in the launch window.

- Customer Feedback and Market Reaction: Inventory might also be affected by qualitative factors. For instance, early customer reviews or social media buzz can influence demand. Monitor what’s being said about the product post-launch. If a positive review goes viral and spikes interest, be ready for a surge in orders that might require inventory action. Or if a negative issue is flagged (e.g., a feature not working as expected), it could dampen demand or cause returns – you’d need to adjust inventory and perhaps halt additional production until it’s addressed.

- Keep the Cross-Functional Team Engaged: Remember that launch team you assembled in Step 1? Continue to have quick sync-ups during the launch phase (even daily briefings if needed). Share the latest sales numbers, inventory status, and any red flags. This keeps everyone aligned. For example, if inventory is running low, marketing might postpone a planned promotion to avoid exacerbating a stockout, or if sales are booming, finance might need to approve extra budget for overtime or rush logistics.

Monitoring and adapting in real time ensures that your inventory plan remains aligned with reality. It’s the execution phase where all the preparation either proves successful or needs course-correcting. By staying vigilant and flexible, you can address issues before they become major problems and capitalize on opportunities that arise unexpectedly.

10. Review Performance and Refine Post-Launch

Once the dust has settled after the initial launch period (this could be a few weeks to a couple of months in, depending on your product and industry), it’s important to conduct a thorough review. The insights gained here will not only help in managing ongoing inventory for this product but also improve future product launch planning:

- Compare Forecast vs. Actual: Analyze how your initial forecasts stacked up against real sales figures. Were you overly optimistic, or perhaps too conservative? Break it down by region, channel, and time period. For instance, maybe you found that demand in Europe was 50% higher than expected but in North America 20% lower. Understanding these variances helps refine your forecasting models. It can also explain any inventory outcomes (such as “Why did we end up with excess stock in NA? Oh, because sales were lower while we allocated inventory assuming higher sales.”).

- Inventory Metrics: Look at key inventory performance indicators for the launch period. What was the service level (percentage of orders fulfilled without stockout)? Did any stockouts occur, and if so, where and why? Conversely, how much inventory is left unsold after the launch rush and where is it? Calculate metrics like sell-through rate (how much of the initial inventory was sold in the launch window) or inventory turnover for that product. These metrics highlight how effective your inventory planning was.

- Cost Analysis: Evaluate the costs associated with the inventory plan. This includes any expediting costs (e.g., did you incur high air freight costs to rush additional stock?), any penalties or rush charges from suppliers, overtime costs for production, or holding costs for excess inventory. By tallying these, you can quantify the impact of any planning inaccuracies. Perhaps you spent extra on logistics due to underestimating demand in one area – that’s a learning point (maybe next time allocate more upfront or stage inventory differently).

- What Went Well and What Didn’t: Conduct a post-mortem with the cross-functional team. Identify the aspects of the inventory planning and execution that were successful. Maybe your early collaboration paid off and forecasting was on point, or your decision to hold safety stock saved the day when a supplier was late. Also, frankly discuss what didn’t go as planned. Was there a communication breakdown at any point? Did the inventory system work as expected under pressure? Did any supplier fail to deliver as promised? These insights are gold for continuous improvement.

- Adjust Ongoing Strategy: Based on the performance, adjust your go-forward inventory strategy for the product. The launch might be over, but now this product becomes part of your regular product portfolio. Set new stock targets, replenishment strategies, and perhaps even re-evaluate the supply chain if needed (for example, now that demand is clearer, you might renegotiate terms with suppliers or adjust production rates to better match actual demand). Also, if you ended up with excess launch inventory, plan how to unwind that – it could be through promotions, or gradually tapering down production until the excess is sold off.

- Incorporate Learnings into NPI Process: Feed the learnings back into your New Product Introduction process. If there was a forecasting error, maybe it indicates a need for better market research next time. If a supplier issue occurred, perhaps involve suppliers earlier or diversify sources for new materials in future launches. Over time, these adjustments make each subsequent launch smoother.

- Celebrate Successes: Don’t forget to acknowledge what went right and celebrate the team’s hard work. Launches are intense, and if your planning prevented major issues or if the product sold well, that’s a win. Recognizing the team’s efforts boosts morale and reinforces the importance of good planning.

A post-launch review closes the loop on the inventory planning process. It’s how you turn experience into improved practice. Manufacturing is an ongoing learning journey, and each product launch is an opportunity to strengthen your operations.

Conclusion

Inventory planning for a new product launch in manufacturing is a critical exercise that blends art and science. It requires thoughtful forecasting, meticulous coordination, and the flexibility to adapt on the fly. By addressing the challenges head-on – from demand uncertainty to supply chain readiness – and following a structured planning process, companies can greatly increase the chances that their new product hits the market without a hitch.

In summary, the key is to plan early, plan thoroughly, and stay agile. Use data and collaborative insight to drive your initial plans, equip yourself with modern inventory management tools like CyberStockroom for real-time visibility, and keep a responsive mindset during the launch period. When done right, inventory planning becomes an enabler of a successful product launch rather than a source of stress. It ensures that when the big day comes, customers find the product available and the company can capitalize on the momentum of the launch – all while keeping costs under control.

Launching a new product will always have elements of the unknown, but with solid inventory planning and execution, you can greet the challenge with confidence. Here’s to your next new product launch being smooth, efficient, and a resounding success!

Leave a comment