Just-in-Time (JIT) inventory management has been a cornerstone of lean manufacturing for decades. The promise is simple: receive or produce goods exactly when needed, minimizing storage costs and waste. In stable times, this strategy supercharged efficiency – companies saved money by not stockpiling parts and could adapt quickly to new products or demand shifts. However, the past few years have been anything but stable. Global events like pandemics, trade disruptions, and natural disasters have exposed the vulnerabilities of pure JIT systems. Many manufacturers learned the hard way that running supply chains with zero slack can lead to costly shutdowns when the unexpected strikes.

So, here we are in 2025, with manufacturers asking a critical question: Is just-in-time inventory still a realistic strategy, or a risky bet in today’s world? The answer is not black-and-white. In fact, a new consensus is emerging: JIT is not dead, but it must evolve. Companies worldwide are rethinking “lean” inventory by adding a dose of resilience. Some are blending just-in-time with “just-in-case” (holding safety stock) to get the best of both worlds. Others are turning to technology – from advanced analytics to cloud-based inventory systems – to make JIT more flexible and dependable. In this blog, we’ll explore how JIT inventory management is being recalibrated for 2025. We’ll look at why JIT became so popular, what went wrong recently, and how manufacturers are adapting through hybrid strategies, smarter planning, and better tools.

JIT 101: Why Manufacturers Love “Just-in-Time”

It’s easy to understand the appeal of just-in-time inventory. Why keep a huge warehouse of parts or products that might not be used for months (or at all) if you can get them right when you need them? JIT, which originated with Toyota’s famous production system, aims to eliminate excess inventory as a form of waste.

Under JIT, materials flow into the factory exactly on schedule for production, and finished goods are shipped out immediately to meet orders. The benefits of this approach made JIT nearly synonymous with efficient manufacturing by the late 20th century:

- Lower Inventory Costs: By holding less stock, companies spend less on warehousing, insurance, and inventory carrying costs. Capital isn’t tied up in unsold goods. This frees up cash for other uses, like R&D or equipment upgrades.

- Less Waste: JIT inherently reduces overproduction and scrap. You’re not building things that don’t have a buyer. This tight alignment of supply with demand means fewer obsolete items and less risk of spoilage for perishable goods. (For example, a food manufacturer using JIT will produce only the quantities needed to fulfill orders, so products don’t sit and expire on a shelf.)

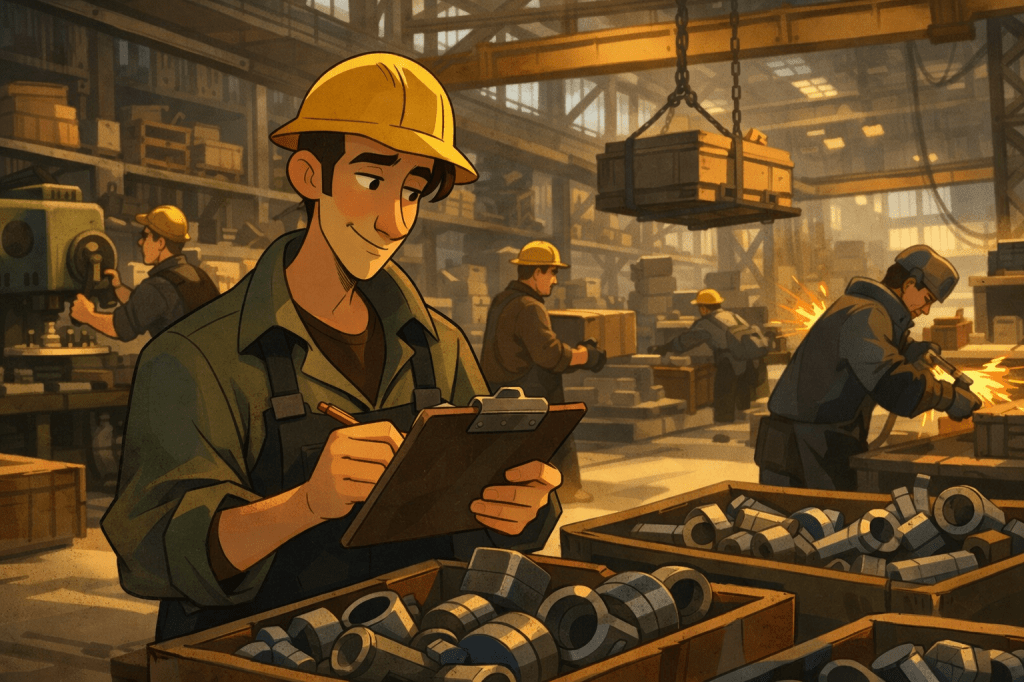

- Improved Quality: With smaller batches and lower inventory, quality issues can be spotted and addressed faster. If you only have 100 units in process instead of 10,000, a defect is caught earlier and doesn’t taint a huge stockpile. JIT also encourages close relationships with suppliers to ensure parts are high quality – there’s no “cushion” of extras, so quality must be right the first time.

- Efficiency & Flexibility: When done correctly, JIT creates a smooth production flow. Assembly lines don’t get bogged down waiting for parts, since everything arrives just in time. This can shorten production lead times and make it easier to switch over to new products. In fact, one often-cited benefit of JIT is how it speeds up responsiveness – with less in-process inventory, manufacturers can pivot to changes in design or demand more quickly. It’s like steering a nimble speedboat versus a cargo ship.

- Sustainability: An often overlooked advantage in today’s context is that JIT aligns with sustainability goals. By minimizing unnecessary production and inventory, companies can reduce waste and energy use. There’s less overstock that ends up scrapped or dumped. JIT’s emphasis on efficiency inherently means a smaller resource footprint to produce the same output. In an age where consumers and investors care about ESG (Environmental, Social, Governance) metrics, this is a big plus.

Given these benefits, it’s no surprise that JIT became the standard for many manufacturers from the 1980s onward. “It was so successful that JIT manufacturing is no longer an innovation – it became the norm,” as one analysis put it. Companies across industries – automotive, electronics, aerospace, retail, even fast food – embraced lean, just-in-time principles to cut costs and boost productivity.

However, JIT’s very strengths (lean efficiency, minimal buffers) also became its Achilles’ heel when conditions turned chaotic. To understand how realistic JIT is in 2025, we need to examine how recent crises exposed the fragility of this model – and what manufacturers are doing about it.

The Stress Test: JIT Under Strain in a Turbulent World

If JIT was the golden child of manufacturing, the past few years have been a tough test of its mettle. Global supply chain disruptions – from COVID-19 lockdowns to geopolitical upheavals and natural disasters – essentially stress-tested JIT systems to their limits. The results were sobering. Even the most advanced companies found that lean inventories left them vulnerable when suppliers suddenly shut down or transport networks snarled.

Remember the headlines about factories idling because a tiny $1 or $2 part was unavailable? That actually happened, repeatedly. A stark example: During the 2021 semiconductor shortage, automakers had to park thousands of half-finished vehicles (some worth $50,000 or more) because they were waiting on microchips that cost just a few bucks. Why? Their JIT supply chains kept almost no extra chips on hand, so when chip factories overseas got hit by fires and pandemic delays, production ground to a halt. This was not an isolated case – industries from electronics to appliances experienced similar bottlenecks.

What went wrong?

In hindsight, many companies realized they had taken JIT too far or implemented it without sufficient safeguards. They were ultra-lean but not resilient. JIT works brilliantly under predictable conditions, but in turbulent environments, it gets you into trouble very quickly. The pandemic certainly qualified as turbulence. Early on in 2020, when factories in Asia shut down and demand patterns whipsawed, many supply chains dropped JIT strategies almost overnight. Companies scrambled to source extra inventory wherever they could, essentially shifting to a just-in-case posture to ride out the uncertainty.

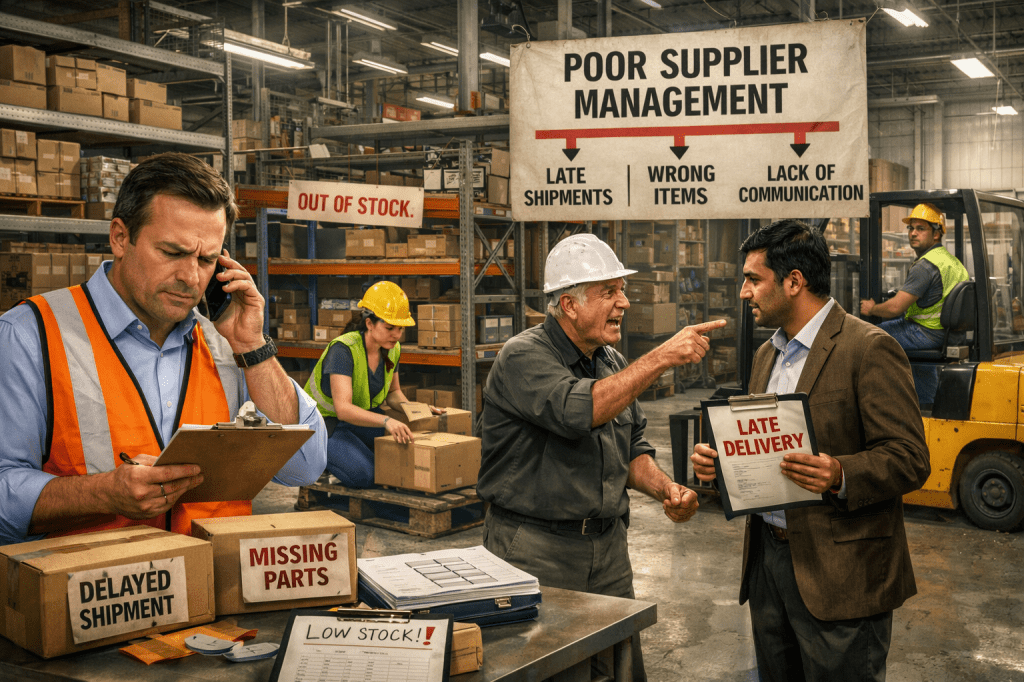

Several interrelated factors made pure JIT a liability in these moments:

- Lack of Buffer for Disruptions: By definition, JIT eliminates safety stock. So there’s no cushion when a supplier can’t deliver on time. A single missing component can stop a whole production line. We saw this with critical parts like semiconductors, but also mundane items like packaging materials. One operations executive quipped that JIT stands for “Just Isn’t There” when things go wrong, which rang true in 2020-21.

- Globalized Supply Chains: Over past decades, manufacturing supply chains stretched around the world in pursuit of low costs. A JIT model that might work beautifully when your suppliers are next door becomes risky when your parts travel across oceans. Long, complex supply lines are inherently more prone to delays – and we’ve had plenty of delays. Ocean freight backlogs, port closures, even a giant ship blocking the Suez Canal, all made headlines. JIT systems reliant on far-flung suppliers faced more points of failure. The very originator of JIT, Toyota, learned this lesson: after a 2011 earthquake in Japan, Toyota realized its chip suppliers were a single point of failure, and it started stockpiling 2–6 months of critical semiconductors as a contingency. That move paid off a decade later; Toyota was one of the few automakers relatively unfazed by the 2021 chip shortage, while rivals had to halt production. The takeaway? Even JIT champions concluded that some buffer is necessary for globally sourced, high-risk components.

- Unpredictable Demand Swings: JIT relies heavily on accurate forecasting – you need to know what you’ll need just in time. But 2020-2022 threw forecasts out the window. One quarter, demand collapsed; the next, it spiked. Consumer behavior changed rapidly (consider the boom in home electronics and DIY gear during lockdowns, vs. the bust in travel-related goods). Many forecasting models simply couldn’t cope, and if you can’t predict demand, you can’t effectively pull inventory JIT. Traditional planning algorithms didn’t account for this level of turbulence. Companies that planned only for “normal” variability were caught off guard by extreme swings.

- Supplier Fragility: JIT assumes your suppliers can deliver reliably and on very short notice. In the real world, those suppliers might be dealing with their own disruptions – labor shortages, raw material scarcities, financial troubles, etc. During the pandemic, lots of smaller suppliers went out of business or struggled to fulfill orders. Sole-sourced parts in a JIT scenario became a single point of failure. To compound this, when everyone is running lean, a disruption cascades: if a tier-2 supplier fails, tier-1 manufacturers have no stock, and the whole chain breaks. It highlighted the need for multi-sourcing and stronger supplier relationships.

By 2023, surveys showed just how widespread the impact was. A stunning 94% of companies reported significant supply chain disruptions had hit their revenue, with average losses around 8% of annual earnings. Supply chain “incidents” (factory fires, shortages, logistics snags, etc.) were up 38% year-over-year – an alarming trend. No wonder, then, that around 80% of organizations rated their supply chain risk as high or very high. In plain English: nearly everyone felt vulnerable. And indeed, research indicates major disruptions (like a factory shutdown or port closure) now occur every 3.7 years on average for a given company – and often last a month or more when they hit.

Faced with these hard truths, manufacturers had to adapt. Completely abandoning JIT and reverting to old-school huge inventories isn’t ideal – that would throw away the efficiency gains and create other problems (like high costs and potential waste). Instead, what we’ve seen is a push towards balance. Many firms have embraced some form of just-in-case inventory as a complement to JIT for critical items. In fact, by 2024 78% of companies had adopted increased buffering (safety stocks) or diversified their supplier base to boost resilience, a 14% rise from prior years. Warehousing space is in high demand again – global warehousing needs surged by an estimated 15–20% as companies started holding more stock as insurance. Essentially, the pendulum swung (at least partially) back towards holding inventory to cope with unpredictability.

JIT vs. JIC: Finding the Sweet Spot

This brings us to the key trend of 2025: hybrid inventory strategies. Rather than view JIT (just-in-time) and JIC (just-in-case) as all-or-nothing opposites, savvy manufacturers are mixing elements of both to craft more robust supply chain strategies.

The goal is to get the best of both worlds – maintain lean, efficient flows wherever possible, but also build buffers and flexibility where needed to absorb shocks.

What does this balance look like in practice? It can take a few forms:

- Safety Stock for Critical Components: Companies are identifying which parts or materials are truly mission-critical and prone to shortage, and keeping extra of those on hand (even if they JIT everything else). The semiconductor example fits here – chips are high risk, so hold a buffer. Another example might be specialized electronic components, or a unique chemical compound without easy substitutes. A 2025 survey found many firms classifying their inventory and stockpiling high-value or long-lead-time items while still minimizing stock of generic, low-risk items. One aerospace parts distributor noted that they “do the opposite of just-in-time” for their most important SKUs now, building healthy buffers for those, but they don’t overbuy slow-moving, low-value parts that would tie up cash uselessly. In other words, not all inventory is equal – you might run JIT on 80% of items, but the other 20% (the critical ones) you treat more cautiously.

- Multi-Sourcing and Localizing Supply: Another way companies are reducing JIT risk is by broadening their supply base and bringing it closer to home. If you have two or three suppliers (preferably in different regions), a single disruption is less likely to stop you cold. And if at least one of those sources is nearby (same country or region), you can get parts faster in a pinch. This trend is often called “nearshoring” or “regionalization” of the supply chain. For example, a manufacturer might continue sourcing some components from overseas for cost savings but also establish a local supplier or stock hub for quick JIT deliveries domestically. Hybrid models like this are gaining momentum. The logic: use offshoring for efficiency (bulk production in low-cost regions), but use domestic “just-in-time” inventory for agility. In practice, that could mean importing a container of parts from abroad (maybe on a slower schedule), then holding a smaller buffer in a local warehouse that feeds the factory JIT with 1–3 day lead times. This way, the plant gets the benefit of JIT responsiveness, while the company still enjoys lower costs on the bulk supply side – and if global shipping is delayed, the domestic buffer buys time.

- Dynamic SKU Segmentation: Companies are also getting smarter about which products or SKUs truly need JIT treatment versus which can be buffered. This often involves data analysis of sales velocity, demand variability, and profitability. If a certain component is used constantly and predictably, you might keep that lean. If another is highly unpredictable or rarely used, keeping a small stock “just in case” might make sense. Executives mention doing quarterly reviews of their product portfolio to adjust these strategies. The idea is stratifying inventory – not a one-size-fits-all approach. For instance, a manufacturer might categorize items into A/B/C classes: A = critical, high-risk (keep safety stock), B = moderate (maybe some buffer or quick supplier on standby), C = low risk (run JIT). This kind of nuanced approach is far more common now than the pure JIT across the board that was popular pre-2020.

- Flexible Contracts and Collab with Suppliers: Some companies are negotiating more flexible arrangements with suppliers – like options to expedite orders, or vendor-managed inventory programs where the supplier holds some stock ready for you. The relationship aspect of JIT has come into sharp focus. The original Toyota system worked partly because Toyota had very close, trust-based relationships with its suppliers. Now manufacturers are re-emphasizing collaboration: sharing forecasts, co-developing contingency plans, even co-locating supplier reps at their sites in some cases. The motto might be “JIT with trust, not just tech.” This way, if there’s a hiccup, your suppliers will prioritize you (and possibly even carry a little extra inventory on your behalf).

It’s worth noting that not everyone will strike the same JIT/JIC balance. The “right” mix depends on the industry and a company’s specific circumstances. For example, the automotive industry – once the poster child for JIT – has shifted to a more hybrid stance (as illustrated by Toyota’s chip stockpiling) because some car components have insane lead times and high stakes if missing. In contrast, a fast-fashion apparel producer with very unpredictable style trends might actually lean more on JIT (via rapid local production runs) to avoid overstocking clothes that go out of fashion. Their “disruption” risk is more about demand uncertainty than supplier failure.

The key point is that 2025’s supply chain mantra is resilience meets efficiency. Companies are openly talking about supply chain resilience and risk management as equally important as cost-cutting. Just-in-time isn’t being discarded; it’s being revamped and supplemented. In fact, a Harvard Business Review piece pointed out that abandoning JIT entirely would be a mistake – instead, the task is to “revamp it” with smarter design. That means keeping the lean principles but acknowledging real-world risks and preparing for them.

Tech to the Rescue: Making JIT Smarter and Safer

One reason JIT is still very much alive in 2025 is that we have new technology tools to mitigate many of its traditional challenges. If the last few years exposed the weak links in just-in-time practices, advances in digital tech are providing the fix – or at least making those links stronger. Here are a few ways technology is enabling more realistic JIT strategies now:

Predictive Analytics and AI Forecasting

The Achilles heel of JIT is forecasting accuracy. Miss the demand forecast, and you either end up with too much (waste) or too little (stockouts). Enter artificial intelligence. Modern AI and machine learning algorithms can analyze vast amounts of data – past sales, market trends, even factors like weather or social media buzz – to predict demand more accurately than traditional methods.

In 2025, we’re seeing companies use AI-driven demand planning tools that continuously learn and improve forecasts. For instance, AI can detect patterns that a human might miss (like subtle shifts in buying behavior) and adjust inventory needs accordingly. One professor noted that with the rise of generative AI, “prediction is bound to get better” for supply chains. Better forecasts mean fewer surprises – and a stronger foundation for JIT.

Real-Time Supply Chain Visibility

One of the scariest things in a JIT system is flying blind – not knowing there’s a delay or a shortage until it’s too late. New visibility tools aim to prevent that. Internet of Things sensors, tracking devices, and cloud platforms now allow companies to monitor their inventory and shipments in real time from end to end. For example, smart tracking can show that a critical shipment of parts is stuck at Port X and is going to be late immediately, giving you time to activate a backup plan. Likewise, inventory management software can show you, at a glance, the exact stock levels across all your warehouses and facilities right now. Real-time alerts and dashboards mean no more waiting for a weekly report to discover a shortfall – you know and can act instantly. This kind of visibility is crucial for making JIT feasible despite uncertainty. It essentially shrinks reaction times from weeks to hours or minutes.

Advanced Planning and Scheduling (APS) Systems

Planning a JIT operation is like solving a complex puzzle – you have to coordinate production schedules, supplier deliveries, and logistics with precision. Modern APS software, often enhanced with AI, can crunch this complexity and spit out optimized plans. These systems consider constraints like machine capacities, labor shifts, and material lead times and come up with production sequences that minimize waiting and inventory. They can also run simulations: e.g., “What if supplier A is 2 days late – how do we adjust?” This helps planners proactively prepare for hiccups. Essentially, better planning tools reduce the risk that JIT will be derailed by internal scheduling issues or suboptimal decisions.

Automation and Robotics

Automation in factories and warehouses can support JIT by making throughput more consistent and reliable. Robots don’t call in sick, and automated guided vehicles (AGVs) can whisk materials to the line just in time with pinpoint repeatability. Automated production lines can ramp up or slow down quickly in response to demand signals, which adds agility.

Moreover, predictive maintenance (using AI to predict machine breakdowns) ensures equipment issues don’t unexpectedly halt production when you have no buffer inventory. Many plants have invested in IoT sensors on machines that alert maintenance teams before a breakdown occurs – so they can fix it proactively during a scheduled downtime. This reduces the unexpected stoppages that would wreak havoc in a JIT flow.

Collaborative Networks and Blockchain

On the cutting edge, some companies are exploring blockchain or other shared-ledger technologies to improve supply chain trust and transparency. In a JIT context, blockchain can provide an immutable, real-time record of transactions and shipments. This can help multiple parties (suppliers, manufacturers, logistics providers) coordinate better since everyone sees the same data. For example, if you use a blockchain-based system with a key supplier, you both can see inventory levels and in-transit goods, triggering automatic replenishments exactly when needed with high confidence. Blockchain also helps with traceability (important for quality and compliance), which is a side benefit. While not mainstream everywhere, increased supply chain integration – even through traditional cloud portals – is making JIT more of a joint effort rather than each company working in its own silo.

Analytics for Inventory Segmentation

We talked about how firms are stratifying which items to handle JIT vs JIC. Data analytics tools now make that segmentation more scientific. Companies can feed in their inventory and sales data and get insights like “These 50 SKUs are low-volume but highly volatile in demand – better keep a buffer” or “Those 20 items have stable demand and long lead times – consider local sourcing or stock.” This beats old gut-feel approaches. In short, data-driven decision-making is guiding where to apply JIT and where not to. Cloud-based analytics dashboards, sometimes powered by AI, give supply chain managers a clear view of risk vs reward for inventory decisions.

The common thread here is information and agility. Technology is giving manufacturers much more information, much faster – and even making decisions automatically in some cases. This reduces the uncertainty that made JIT scary. If you have confidence in your forecast (thanks to AI), a clear view of your pipeline (thanks to real-time tracking), and contingency plans at the ready (thanks to good planning tools), you can run leaner without being blindsided.

That said, tools are only as good as how you use them. Companies must still instill a culture of responsiveness and flexibility. But in 2025, even medium-sized manufacturers have access to affordable cloud software that was unthinkable 20 years ago. This levels the playing field – you don’t have to be Toyota or Walmart to run a sophisticated JIT-lite operation anymore.

Before we wrap up with the big picture of JIT’s feasibility, let’s zoom in on one particular toolset that is helping companies manage inventory smarter: CyberStockroom’s visual inventory management platform. This serves as a great example of how modern software is addressing the on-the-ground challenges of inventory control in a JIT context.

Achieving Lean Inventory with Visibility: The CyberStockroom Approach

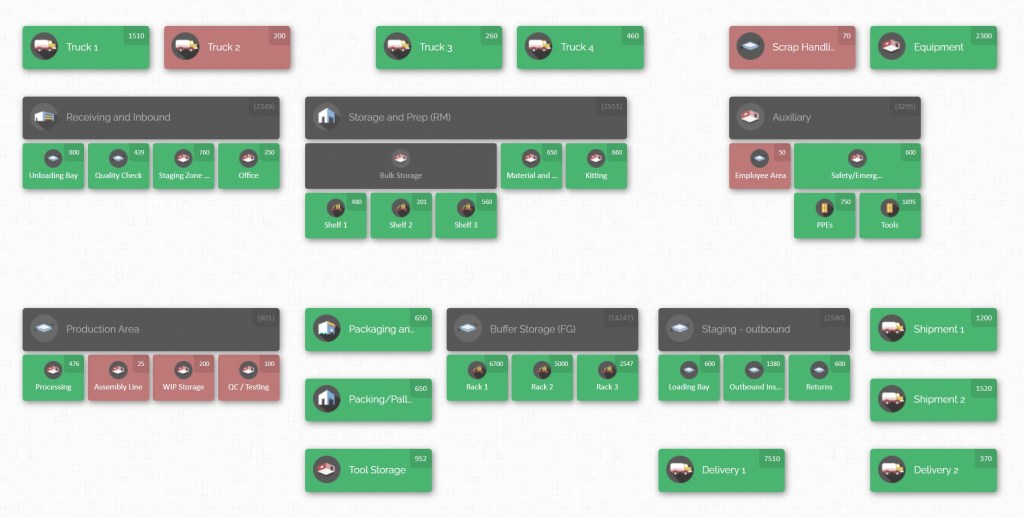

Modern inventory management is not just about keeping count of stock – it’s about having complete visibility and control so you can make fast, informed decisions. This is exactly where CyberStockroom comes in. If you haven’t heard of it, CyberStockroom is a cloud-based inventory management software with a unique twist: it uses an interactive visual map to represent your inventory. Instead of endless spreadsheets or cryptic database entries, you literally get a map of your business – showing every location (warehouses, factories, stockrooms, even vehicles or job sites) and what inventory is at each spot in real time.

Imagine opening up a dashboard and seeing a birds-eye view of all your warehouses and production areas, with sections that show how much of each item is present. Need to find where that critical Part X is stored? Just click on it, and the map lights up to show you – perhaps 50 units at Warehouse A, 20 units at Plant B, and another 5 on a service truck en route. CyberStockroom’s inventory mapping gives instant clarity on where everything is, which is incredibly powerful for managing a lean operation.

Here are some key ways CyberStockroom helps manufacturers (and other businesses) make JIT more realistic and manageable:

Multi-Location, Real-Time Tracking

CyberStockroom was built to handle inventory across multiple locations seamlessly. Whether you have one stockroom or dozens of warehouses globally, all inventory data feeds into one unified system in the cloud. As stock moves, the system updates in real time. This means a manager at HQ can see right now if the Los Angeles warehouse has enough widgets, or if the Toronto plant took out 100 units for production this morning. Real-time visibility across all sites eliminates guesswork. In JIT terms, this is gold – you can’t run lean if you don’t trust your inventory data. CyberStockroom makes sure you always know the truth of your inventory levels at every location, minute by minute.

Visual Inventory Mapping

The signature feature – and a game-changer for many users – is the visual map interface. You essentially create a digital twin of your storage and production environment: warehouses, rooms, aisles, shelves, even down to bins if you want. Drag-and-drop tools let you customize the layout to mirror reality. Why does this matter? Because seeing inventory in context helps you manage it better. You can spot bottlenecks or imbalances at a glance.

For example, your map might show that one storeroom is overflowing with raw material A, while another site is nearly empty – prompting you to transfer stock rather than ordering more. It’s a bit like an RTS game interface for your inventory – intuitive and actionable. For JIT, this means you can quickly reallocate or reposition stock to where it’s needed just in time, because you have that bird’s eye view. CyberStockroom essentially acts as a control tower for your inventory.

Streamlined Stock Movements (Transfers & Adjustments)

In a lean system, you’re often moving items around to meet demand – sending parts to a production line, transferring excess stock from one warehouse to another, etc. CyberStockroom makes this easy with features to record transfers, check-ins, and check-outs of inventory with just a few clicks or scans. Let’s say a factory needs 50 more units from the central warehouse: you can log that transfer in seconds, and the map updates both locations’ counts immediately. This real-time adjustment is crucial so that your data is never out of sync. Plus, it provides an audit trail – you’ll always know who moved what, when. That history is useful for continuous improvement, helping identify usage patterns or potential issues (e.g., frequent emergency transfers might signal you should stock that item closer to the consumption point).

Barcode Scanning & Mobile Access

Another practical feature – CyberStockroom supports barcoding and has a mobile-friendly interface for on-the-floor use. Warehouse workers or technicians can use a tablet or smartphone (no separate app needed; it works through the browser) to scan items as they are used, received, or moved. This is huge for data accuracy. In traditional systems, if someone forgets to log a part used on the shop floor, your inventory records go out of whack. With CyberStockroom, an employee can quick-scan a barcode and instantly update the inventory while standing right in front of the shelf. The mobile view is optimized for speed – it even has a QuickScan mode for rapid back-to-back scans without lag. The result is that your on-site teams actively keep the system updated as part of their regular work. When everyone participates like that, JIT becomes safer because you’re far less likely to get a nasty surprise of “oh, we thought we had 20 in stock but actually we have 0.” CyberStockroom basically makes maintaining accurate, real-time inventory data effortless, even for busy staff.

Mapping the Production Process (WIP Tracking)

For manufacturers, one very cool use of CyberStockroom is mapping out production stages or work-in-progress (WIP) areas. You can create a process flow map that represents each step in your manufacturing line – for example, Receiving -> QC Inspection -> Assembly Line -> Finished Goods Storage. As items move through, you can update their location on the map. This gives you visibility of inventory within the production process, not just in stockrooms. It’s like tracking parts as they become products. How does that help JIT? Well, it means you can identify bottlenecks or delays immediately. If products are piling up in the QC stage, you’ll see that on the map and can intervene (maybe QC is understaffed). Or if Assembly is starved of components, you’ll see WIP inventory dropping and can investigate why the parts didn’t arrive just in time. Essentially, CyberStockroom extends inventory visibility into the factory workflow, which is critical for coordinating JIT production. It ensures that the flow part of “just-in-time flow” is visually monitored and managed.

Better Collaboration and Accountability

The visual nature of the system makes it easy for different teams – purchasing, warehouse, production, even finance – to stay on the same page. Instead of each department maintaining their own spreadsheets and having weekly meetings to reconcile, everyone can look at the same live inventory map. This transparency fosters collaboration. For example, the purchasing team can see that a certain raw material is low at a glance and reorder proactively, without someone from the plant having to call them. Likewise, sales can check if finished goods are available to promise to a customer. CyberStockroom even allows mapping by team or department responsibility, so you can assign areas or items to owners, increasing accountability (e.g., “Maintenance department owns these spare parts stock – and it’s visible how many they have”). In sum, it breaks down silos around inventory information. When running lean, such tight coordination is essential. Everyone needs to act quickly on the same data, and this platform facilitates that.

Ease of Use and Cloud Convenience

Unlike some legacy ERP inventory modules that require specialized training, CyberStockroom prides itself on a user-friendly interface. The drag-and-drop, map-based design is intuitive (if you can read a floor map, you can use it). This means faster onboarding and compliance – employees are more likely to actually use the system, which is half the battle in keeping data current. And because it’s cloud-based, there’s no heavy IT infrastructure to worry about. You log in through a web browser from anywhere. Updates are automatic. For a small or mid-size manufacturer, this lowers the barrier to adopting a sophisticated inventory system. And for larger ones, it means scalability and remote access out of the box. In practical terms: a manager traveling to a supplier can check current inventory on their phone, or multiple warehouses across the globe all feed into one system without complex VPNs or servers. This kind of accessibility is very much in line with the 2025 ethos of flexibility – work from anywhere, manage from anywhere. It definitely supports the agility needed for JIT operations spread across multiple sites.

In short, CyberStockroom acts as a real-time command center for inventory management, wrapped in an easy, visual package. By using a tool like this, manufacturers can confidently operate with leaner inventories because they have unprecedented visibility and control. If a part is running low, they’ll see it. If something is sitting idle for too long, they’ll spot that too. Decisions like “when to reorder” or “where to deploy stock” become data-driven and instantaneous. This significantly lowers the risk of stockouts that normally haunt JIT strategies, without requiring huge stock buffers.

To wrap up this section, the correlation between CyberStockroom and JIT is clear: JIT demands precision and timeliness, and CyberStockroom provides the tools to achieve exactly that with your inventory. It gives manufacturers the confidence to run lean, because they have a firm grip on reality – no more “unknown unknowns” lurking in the warehouse. As we venture further into 2025, adopting modern inventory management solutions like this is becoming a best practice for anyone trying to optimize stock levels without courting disaster.

(As with any software, it’s wise to evaluate if CyberStockroom fits your specific needs. But its focus on visual mapping and simplicity is fairly unique, and it aligns well with the needs of firms trying to implement or sustain JIT.)

The Global Outlook: Is JIT Still Feasible today?

Now for the big question: after all the upheavals and adjustments, how realistic is just-in-time inventory for manufacturers today? The best answer is “It’s realistic if you’re realistic about it.” In other words, JIT can absolutely work and deliver great benefits in current times– but only if implemented with the lessons of the past in mind. Companies that try to copy-paste a 1990s-style JIT system, ignoring today’s volatility, may be in for a rude awakening. On the flip side, those that blend JIT efficiency with strategic safeguards can thrive, enjoying the lean advantage while keeping customers happy even when surprises occur.

Here are some concluding observations on the state of JIT in 2025, drawn from global trends:

- JIT is no longer all-or-nothing: The era of fanatic lean-ness (“zero inventory everywhere!”) is over. Virtually everyone has learned to build in buffers where it makes sense. The new gold standard is a hybrid model. Manufacturers who succeed with JIT now tend to use it as one tool in their toolbox, not a religion. They might run JIT on most inputs but still maintain a strategic stockpile of critical materials (like Toyota does with chips). Or they might do JIT manufacturing but keep extra finished goods ready in regional hubs to meet customer demand spikes quickly. This nuanced approach is what makes JIT realistic – it’s JIT with a safety net.

- Industry differences matter: Some industries have reverted more to just-in-case, at least temporarily. For instance, as noted, aerospace and automotive are keeping higher inventories for certain parts due to extreme lead times. Retail and consumer electronics, which face fast-changing consumer tastes, still lean heavily on JIT to avoid being stuck with obsolete stock (think of how quickly smartphone models turnover – a warehouse full of last-year’s model is a big risk, so those supply chains still push for JIT coupled with agile manufacturing). Healthcare supply chains are a mixed bag: the pandemic taught hospitals not to JIT absolutely everything (gloves, masks, etc.), yet for expensive devices and drugs, they can’t overstock too much either. The point is, “realistic JIT” might look different sector by sector. But across the board, the conversation has shifted to resilience. Companies are doing scenario planning like never before, asking “what if X happens?” and making sure pure JIT has a plan B.

- Geographical shifts support JIT: Globally, there’s a trend toward regionalizing production (often termed the end of hyper-globalization). If more manufacturing moves closer to the end consumer – e.g., more factories in North America serving North America, rather than everything being made in Asia – JIT becomes more viable again because supply lines shorten. We’re seeing policies and industry moves in the US, Europe, and parts of Asia to invest in local semiconductor fabs, battery plants, etc., precisely to avoid the long supply chains that broke JIT models. Over the next decade, this could lead to a resurgence of “true JIT” clusters (not unlike Toyota’s original setup of nearby suppliers). In 2025, we’re at the start of that shift. Many firms are qualifying secondary suppliers in closer regions, even if they still import some volume from afar. As those local supply networks strengthen, expect JIT to get easier and more reliable.

- Technology is a game-changer (and leveling the field): We discussed how AI, real-time data, and tools like CyberStockroom are empowering better JIT. This not only helps those who were already doing JIT, but it also makes JIT accessible to manufacturers who previously thought it too risky or complicated. A small manufacturer with, say, two factories and a couple of warehouses can now use cloud software and analytics to manage JIT nearly as well as a big multinational. In that sense, JIT in 2025 is more realistic for a broader range of companies – you don’t need a massive Toyota-level bespoke system; you can leverage affordable tech. As these technologies continue to mature (think predictive analytics getting even smarter, digital twins, etc.), JIT will become ever more robust. The caveat is that tech adoption itself must be handled well – companies need to invest in staff training and change management so that these fancy tools are actually used properly.

- Mindset and agility are key: Perhaps the most important factor isn’t hardware or software, but flexibility in mindset. If the pandemic taught supply chain managers anything, it’s the value of being quick to adapt. JIT in a volatile era requires a very agile, responsive management style. You might need to make fast decisions – reroute shipments, switch suppliers, temporarily increase inventory – and then dial back when the crisis passes. Organizations that insist on rigid plans or are slow to react will struggle with JIT now. On the other hand, those that cultivate agile teams, contingency plans, and a culture of continuous improvement can handle JIT with finesse. They’re constantly reviewing: Is our JIT approach still working this quarter? Do we need to adjust safety stock levels given the latest news (e.g., a port strike or a commodity shortage)? In 2025, JIT is realistic only for the vigilant and flexible. It’s not a set-and-forget strategy; it’s a dynamic one.

- Customer Expectations Still Push Lean: Lastly, let’s not forget why JIT existed: to serve customers better (cheaper, faster, reliable delivery). Those expectations haven’t gone away – if anything, end customers now expect even faster fulfillment and greater product variety. This keeps pressure on manufacturers to be lean and responsive. Companies that bloated their inventories in 2021/2022 to cope have felt the pain of higher costs and now are trying to optimize again. There’s competitive advantage in getting JIT “right.” If you can operate efficiently and still deliver on time while competitors are struggling with either too much stock or too many shortages, you win. So the incentive is there to refine JIT for the new world. Many businesses are doing exactly that – revamping their just-in-time supply chains rather than abandoning them. They’re implementing dual inventory strategies, new planning algorithms, closer supplier integration, etc., to meet customer needs without reverting to the old days of bloated inventories.

In summary, just-in-time inventory is still a viable and often desirable strategy in 2025, but it’s no longer practiced in the naive way of “eliminate all inventory everywhere.” It has matured. Think of it as JIT 2.0: lean, tech-enabled, and tempered with strategic buffers. Manufacturers who embrace this balanced approach are finding that they can enjoy the efficiency gains of low inventory and sleep a little better at night knowing a hiccup won’t completely derail them. Those who swing to the opposite extreme (hoarding mountains of stock in fear) will likely find that unsustainable and eventually circle back toward leaner methods once they shore up their risk management.

Bottom line: JIT isn’t an on/off switch – it’s a spectrum. In 2025, being realistic about JIT means finding your organization’s place on that spectrum where you minimize waste and cost, yet can handle the “what ifs.” With the right strategy, tools, and mindset, just-in-time can absolutely work and even give you a competitive edge. Without those, JIT might feel like walking a tightrope without a net – doable, but nerve-wracking and potentially disastrous.

Manufacturers around the world are learning to walk that tightrope with a safety harness now. They’re harnessing data, increasing visibility, and keeping a cushion where it counts. So yes, JIT is still alive and kicking – just a bit wiser and more pragmatic than before. In the grand balancing act of supply chain management, 2025’s mantra could well be: “Lean, but not extreme. Efficient, but prepared.” And that is a realistic way to run just-in-time in today’s manufacturing landscape.

Leave a comment